PBBank growth from strength to strength

>> Wednesday, July 27, 2011

Financial Result

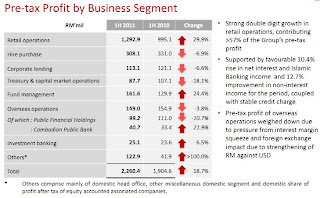

PBBank has just announced its 1H11 financial result two days ago. Its half-year net profit has jump from 1.419bil(1H10) to 1.708bil current year. A whopping 20.3%. If you have a good look at the chart below, its 1H net profit has been growing strongly since 2007.

Technical Outlook

Chartwise, PBB has been trading sideway from the beginning of the year. It trap between a ascending triangle with a top of RM13.25. 3 weeks ago, PBB share price break above this resistance, and firmly above this support now.

With this breakout, i think PBB should be start accelerating. Slowly but surely.

I have my target price at RM14.02.

Overall

Current financial result announcement also come with a RM0.20 single tier dividend declared. I take this as a bonus. With today closing at RM13.46, its trading at P/E14.2 (EPS RM0.944 ttm), trading cheap.

0 comments:

Post a Comment